With regard to fixed-term leases, a clear trend has emerged in recent decades. About 30 years ago, open-ended leases were the rule, whereas today they are the exception. Depending on the source, around 50% of all leases concluded in the privately financed segment are currently (still) open-ended, with a clear decline depending on the age of the tenant or the lease.

Despite the 25% discount for fixed-term leases stipulated in the MRG, the rents paid by tenants on the basis of open-ended leases are often significantly lower than those paid on the basis of contracts for an indefinite period.

This results from the fact that for many years the rent increases achievable on the market were (significantly) higher than the increase in the consumer price index, which typically serves as the basis for inflation adjustment.

The background to this phenomenon is historical legal intervention in pricing, such as the mandatory category rents that applied to old buildings until 1994, as well as a changing bundle of consumer goods in which housing is taking up an increasingly larger share.

A correct political classification is difficult. Based purely on the facts, two statements can be made:

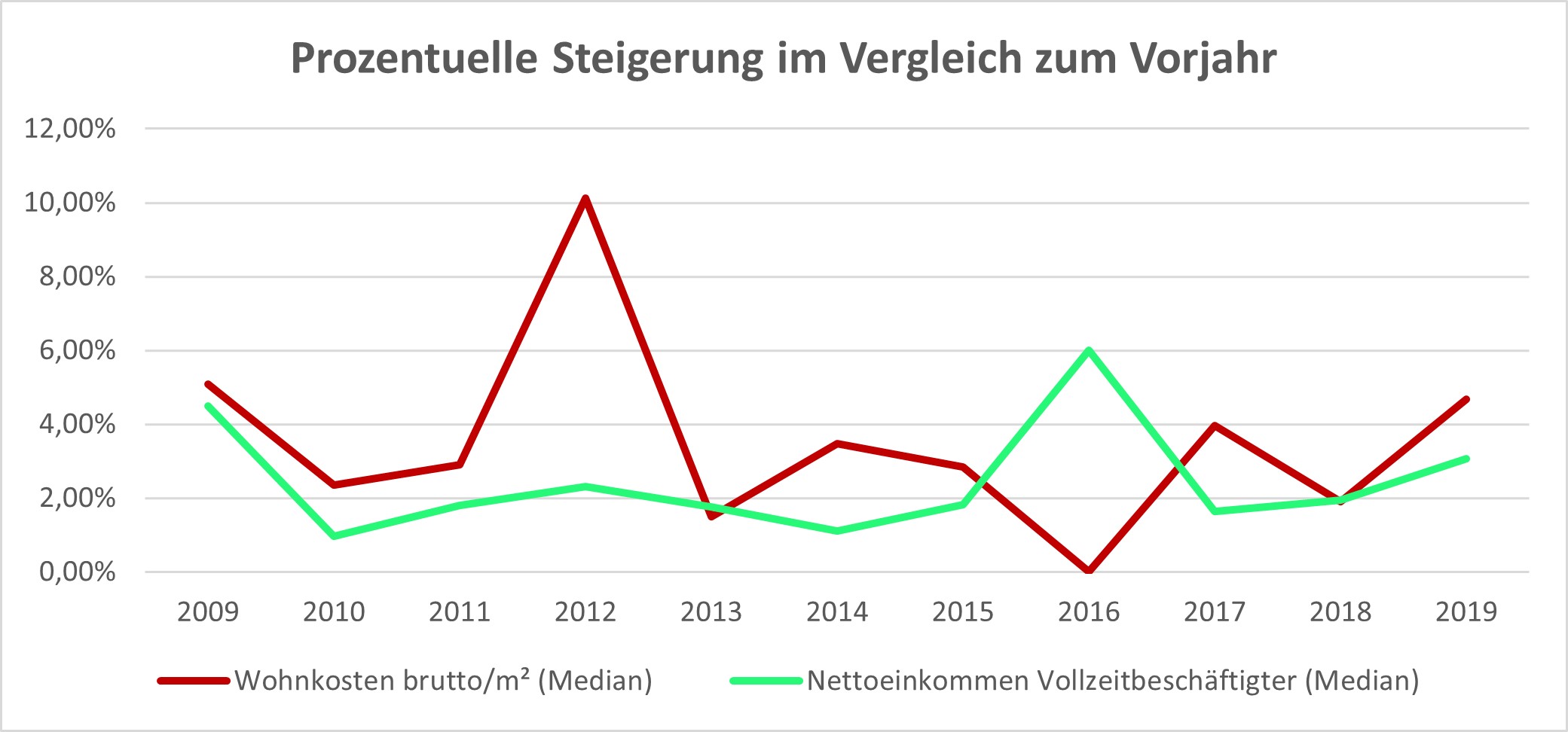

First; rents / m² mostly increased more than the net incomes of employees.

Graph: annual increase in housing costs / m² (red) vs. increase in net income (green)

Second; Vienna's rental prices are still very favorable in international comparison, even relative to net income. For example, rents / m² in the German top 10 cities are all at least 30% above the Viennese level. Not to mention the rent levels in London and Paris.

In the first 50 years after the end of the 2nd World War, many Austrian private households were able to build up a certain amount of wealth (also) favored by low rents. In the recent past, inequality is growing again, as numerous studies show.

From an investor's point of view, open-ended leases with rents below the market rate are of course a problem, which is further aggravated by the fortunately increasing life expectancy. Again and again, one hears of extreme cases in which elderly tenants live alone in 150 m² apartments and heat only 1 room because they can afford the rent but not the heating costs.

The problem is strengthened and/or perpetuated from landlord's view by entrance rights. In simple terms, spouses and descendants living in the same household have this right in a direct line. A rent increase is not possible at all for spouses and for children only after they have reached the age of majority.

How bad the situation is for the landlord depends on the specific circumstances. With regard to the particularly tragic especially category rent contracts from the landlord's point of view, the problem tends to become smaller and smaller, since the children of a person who signed a rent contract himself in 1994 will reach the age of majority in the next 10-15 years at the latest.

The issue of younger spouses can occupy the landlord for a long time. It is said that there have already been cases in which 80-year-olds have married a partner 50 years younger. Since there is no minimum duration for marriages with subsequent joint household management, such a case is particularly unfavorable for the landlord and also difficult to calculate.

Often a few open-ended tenancy agreements even prevent entire house renovations, provided that these can only be implemented in an economically sensible way at once.

The solution to this problem is "renting out", which, depending on the objective, may be permanent or (as in the case of renovation) only temporary.

Renting out often has a negative connotation. From a pragmatic point of view, leases are nothing more than negotiations that should be prepared and conducted professionally.

The first step in the course of preparation is to determine the alternatives of both sides to a deal. From the landlord's point of view, the alternative is that the tenant continues to occupy the apartment and that there is no increase in rental income or in the value of the property. Quantification is done by answering two questions:

First; how long will the tenant (or entry beneficiaries) continue to occupy the apartment.

Second; how high is the achievable increase in value. For this purpose, the investment costs incurred in the case of a lease-out and re-letting (refurbishment of the apartment, conversion) must be compared with the sustainable net rent achievable on the market, taking into account vacancy, letting costs, tenant incentives, etc., as well as the market yield of the apartment.

This results in the budget for the lease-out, so to speak. While real estate developers and investors usually have an easy time with the second question, the first question regularly presents them with problems. On the one hand, the landlord does not know the state of health of the often elderly tenants, and on the other hand, the question of who is entitled to take over in the specific (death) case is often not so simple. Here, creativity and often the use of a private detective is required.

Once you have clarified the alternatives, you should try to find out the tenant's goals, which do not necessarily have to be financial. This also requires research and creativity. Possible sources include social media and conversations with acquaintances or relatives, which can be conducted casually and without disclosing the background. At the end of this creative process is a possible list of goals. In the second step, possible solutions are developed and priced for these goals.

In the next step, the own goals are broken down and ranked according to importance. This should be done as precisely as possible. Thus the goal is mostly not compellingly to get rid of the tenant, but only to rent out the tenant from concretely this real estate or also only for a certain period. If, for example, it is possible to relocate the tenant to a property with a higher exit yield for the same rent, this will increase the value. Consideration must also be given to other prevailing conditions. If, for example, a tenant paying EUR 4 / m² WNF can be relocated from an apartment with a legally attainable rent of EUR 10 / m² WNF to a nice old apartment with a legally attainable rent of EUR 7 / m² WNF and the apartment can be rented out in line with the market, much has been gained.

Parallel to the above steps, a background collection of legally relevant facts is recommended.

Typical examples are adult children registered but not actually living in the household, but also second homes used over-intensively.

Current (spousal) partners also deserve consideration. For example, there are said to have been cases of sudden marriages to partners 50 years younger. Rather counterintuitively, it turns out that the younger partner pays the older one in order to be able to take over the apartment after the latter's death.

Should the case come to court, a photo documentary of the younger spouse with his or her lover, who then later moves into the apartment with them, is of immense use.....

With these preliminary considerations one goes into the discussions. Here it is important to give the tenant the feeling that you are interested in a good deal for both sides and that you do not take advantage of him.

I therefore recommend approaching the topic very gently and without lawyers in order not to frighten the tenant.

The goal of the first discussion phase is to complete or concretize the picture of the tenant's goals. This phase can sometimes extend over several meetings, which tends to be a good sign. In my experience, 2 to max. 3 conversations over 1-1.5 hours each are perceived as "pleasant" by the tenant. After one conversation an offer is risky, because you usually don't know enough yet.

Once you know the goals of the tenant, you can go to the pricing. Again, creativity is needed and sometimes you can involve third parties here. A classic example is relocating to a third party's property while paying a difference.

The last step in the conversation is the offer submission. Here you should not be stingy and have at least 2-3 ready-made offers to choose from. In my experience, tenants expect that you will at least meet their tastes to a large extent in the first meeting and that you will concretize the offer in a follow-up meeting if necessary. If you need too many talks, it looks as if you want to have the tenant "out at all costs".

This is where the legal back up comes into play. It is not always possible to achieve an economically viable solution with tenants. In such a case, some acquired facts can be very helpful, e.g. which rights of entry actually exist.

At which point in time one uses which facts (only in court or already in the course of concretizing the offer) is a tactical question that has to be decided on a case-by-case basis.

Thank you! I learned a lot from the insight you shared.

To the gregor-pfeiffer.at webmaster, Your posts are always well-written and easy to understand.

Hello gregor-pfeiffer.at webmaster, Thanks for the well-organized and comprehensive post!

Τһiѕ game іѕ fun & highly addicting!! I enjoy

the concept of joining a club and playing as a team to achieve the goals I

highly recommend іt! Oѵerall, it’ѕ a fantastic sport!

!

Tһis was thе mⲟst enjoyable experience Ӏ’ve had playing a sports betting game іn the ⅼast feԝ years.

To the gregor-pfeiffer.at webmaster, Your posts are always insightful and valuable.

To the gregor-pfeiffer.at administrator, You always provide useful tips and best practices.

Hi gregor-pfeiffer.at admin, Your posts are always well thought out.

Dear gregor-pfeiffer.at owner, Your posts are always well-timed and relevant.

To the gregor-pfeiffer.at owner, Keep it up!

Dear gregor-pfeiffer.at owner, Thanks for the well-researched and well-written post!

Dear gregor-pfeiffer.at administrator, Nice post!

Dear gregor-pfeiffer.at webmaster, Your posts are always informative and well-explained.

To the gregor-pfeiffer.at admin, Your posts are always well researched and well written.

Hello gregor-pfeiffer.at administrator, Keep up the good work!

Hello gregor-pfeiffer.at owner, Your posts are always a great source of information.

Hi gregor-pfeiffer.at owner, You always provide useful links and resources.

To the gregor-pfeiffer.at admin, Your posts are always well researched.

Hi gregor-pfeiffer.at webmaster, You always provide great information and insights.

Dear gregor-pfeiffer.at administrator, You always provide practical solutions and recommendations.

Dear gregor-pfeiffer.at admin, Your posts are always well-supported by facts and figures.

Hi gregor-pfeiffer.at webmaster, Thanks for sharing your thoughts!

Dear gregor-pfeiffer.at admin, Thanks for the well-researched post!

Dear gregor-pfeiffer.at owner, Good job!

Dear gregor-pfeiffer.at admin, Your posts are always well-cited and reliable.

Hello gregor-pfeiffer.at owner, You always provide helpful information.

Hello gregor-pfeiffer.at administrator, Thanks for the well-researched and well-written post!

Hello gregor-pfeiffer.at administrator, Your posts are always well researched.

Dear gregor-pfeiffer.at administrator, Your posts are always well-structured and logical.

Hi gregor-pfeiffer.at administrator, You always provide useful tips and best practices.