As a result of the financial crisis and the following Basel II (III, IV) regulations, the requirements for commercial property developments were largely standardized. 80% debt capital represents a benchmark for (residential) real estate developments in the non-luxury segment that is difficult for all real estate developers to exceed. The effective interest rate is around 3% p.a., depending on the developer’s negotiating skills and the bank’s appetite.

Dennoch behaupte ich, dass der Markt kleinere Projektentwickler hinsichtlich der Finanzierungskosten diskriminiert. Um die Auswirkungen quantifizieren zu können, nehmen wir eine erwartete EK-Rendite des Immobilienentwicklers von 25% an. Bei einem „phantasielosen“ EK-/FK-Mix belaufen sich die Finanzierungskosten großer wie kleiner Entwickler auf 80%*3%+20%*25% = 7,4% p.a.

Obviously, the equity tranche is very expensive due to the many risks involved in real estate development, so that all real estate developers try to minimize them from a return point of view.

Let’s look at the possibilities of large and small real estate developers:

- The small real estate developer

In order to keep the administrative costs low, smaller real estate developers usually all develop their properties in one company and sell them as an asset deal after completion.

The most important (and de facto only) approach to lowering the financing costs of smaller real estate developers is crowd investments, which have increased significantly in recent years. The largest platform providers for the Austrian market are Homerocket, Rendity and Dagobert.

With a corresponding track record of the real estate developer and a good presentation, a mezzanine financing share of around 10% can be placed with crowd investors; the effective interest rate, taking into account platform costs, is around 10% p.a.

The average financing costs are therefore 80% * 3% + 10% * 10% + 10% * 25% = 5.9%

- The large real estate developer

For larger projects, crowd investments are unsuitable due to the legal maximum investment amount of EUR 2 million / project, so that they have to switch to mezzanine funds such as Empira or Fint. Although the platform costs are eliminated, the conditions are significantly worse, so that there are no advantages over crowd investing, which is more accessible for smaller developers. With a 15% mezzanine interest rate, this results in a mixed rate of 80% * 3% + 10% * 15% + 10% * 25% = 6.4%

An alternative recently offered are whole loan funds that finance up to 90% debt. Empira currently offers this at an interest rate of 4.5%. Thus, the financing costs amount to 90% * 4.5% + 10% * 25% = 6.55%

At first glance, therefore, no economies of scale can be seen.

In contrast to smaller developers, however, larger real estate developers can afford other structures that enable cheaper financing.

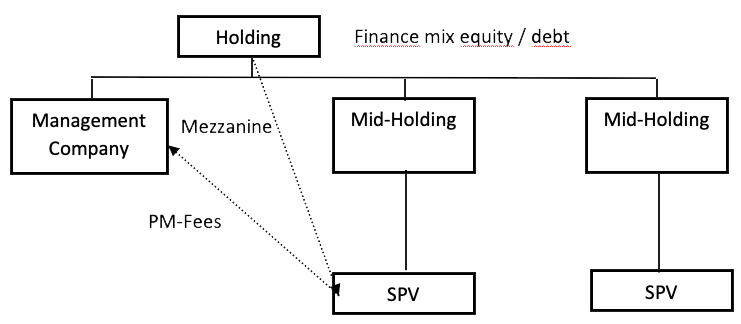

Graphic: typical structure of a large real estate developer

Larger real estate developers finance themselves more cheaply than smaller developers for two main reasons. On the one hand, they use the multi-level structure to reduce the real equity share. For example, they raise debt capital and / or issue bonds at the holding company level and use this money to pass it on to the project companies, whereby a debt/equity ratio of 50% is quite common. The effective interest rate of these bonds or provided debt lines is currently around 3-3.5% depending on the size and timing.

The calculated equity share is 5%.

In addition, project management fees are charged with around 10-15% surcharge, so that the equity share at group level is reduced by around 2.5 percentage points.

Assuming that mezzanine is again borrowed for 15% at project level, this results in a mixed interest rate of 80% * 3% + 10% * 15% + 7.5% * 3.5% + 2.5% * 25% = 4.79%

The following conclusion can be drawn from the above statements:

- Larger real estate developers can de facto finance themselves without significant equity capital (in the above example 2.5%). Expensive IPOs are therefore relatively uninteresting for traditional trade developers. As long as a certain minimum of equity remains in the company, the profits can be distributed to a large extent.

This conclusion can also be observed empirically. In Austria there is de facto only one listed trade developer, UBM, whereas numerous larger unlisted developers have been in the media with exciting projects for years.

- Size also helps in terms of financing costs.

Hi gregor-pfeiffer.at webmaster, Keep it up!

Dear gregor-pfeiffer.at administrator, Your posts are always well-cited and reliable.

Hello gregor-pfeiffer.at webmaster, Well done!

Dear gregor-pfeiffer.at admin, Well done!

To the gregor-pfeiffer.at owner, Excellent work!

Dear gregor-pfeiffer.at administrator, Thanks for the well-organized and comprehensive post!

Hello gregor-pfeiffer.at webmaster, Your posts are always insightful and valuable.

To the gregor-pfeiffer.at administrator, You always provide in-depth analysis and understanding.

Hi gregor-pfeiffer.at admin, Your posts are always on topic and relevant.

Dear gregor-pfeiffer.at admin, Your posts are always well-written and engaging.

Hello gregor-pfeiffer.at webmaster, You always provide great examples and case studies.

Dear gregor-pfeiffer.at owner, You always provide useful information.

Hello gregor-pfeiffer.at owner, Your posts are always informative and well-explained.

Hello gregor-pfeiffer.at administrator, Thanks for the great post!

Dear gregor-pfeiffer.at webmaster, Your posts are always well-received by the community.

Dear gregor-pfeiffer.at administrator, Thanks for the well-organized post!

Hi gregor-pfeiffer.at webmaster, Your posts are always well organized and easy to understand.

Hi gregor-pfeiffer.at admin, Keep up the good work!

Dear gregor-pfeiffer.at administrator, Your posts are always on topic and relevant.

To the gregor-pfeiffer.at webmaster, You always provide valuable information.

To the gregor-pfeiffer.at administrator, Your posts are always well researched and well written.

Hi gregor-pfeiffer.at owner, You always provide great examples and real-world applications.

Hello gregor-pfeiffer.at webmaster, Thanks for the great post!

Hello gregor-pfeiffer.at owner, Good to see your posts!

To the gregor-pfeiffer.at owner, Your posts are always a great source of knowledge.

Hello gregor-pfeiffer.at admin, Thanks for the well written post!

Hello gregor-pfeiffer.at owner, Great post!

Dear gregor-pfeiffer.at administrator, Keep sharing your knowledge!

Hi gregor-pfeiffer.at administrator, Keep it up!

To the gregor-pfeiffer.at owner, Your posts are always well-written and engaging.

Dear gregor-pfeiffer.at admin, Thanks for the well-organized post!

Dear gregor-pfeiffer.at owner, Your posts are always informative.

Hi gregor-pfeiffer.at owner, Your posts are always well organized and easy to understand.

To the gregor-pfeiffer.at administrator, Keep up the good work, admin!

Dear gregor-pfeiffer.at administrator, Thanks for the well-structured and well-presented post!

Dear gregor-pfeiffer.at administrator, Your posts are always well-cited and reliable.

Hello gregor-pfeiffer.at administrator, Your posts are always thought-provoking and inspiring.

Hello gregor-pfeiffer.at admin, Your posts are always a great read.

Dear gregor-pfeiffer.at owner, Your posts are always well-written and engaging.

Dear gregor-pfeiffer.at administrator, You always provide great resources and references.

To the gregor-pfeiffer.at admin, Thanks for the valuable information!

Hello gregor-pfeiffer.at admin, Thanks for the great post!

Hi gregor-pfeiffer.at admin, Thanks for the well-organized post!

Hello gregor-pfeiffer.at owner, Thanks for the informative and well-written post!

Dear gregor-pfeiffer.at administrator, Your posts are always well-supported by research and data.

Hello gregor-pfeiffer.at webmaster, Good work!

Dear gregor-pfeiffer.at administrator, Your posts are always well-referenced and credible.

Hello gregor-pfeiffer.at administrator, Your posts are always well thought out.

Hello gregor-pfeiffer.at Owner, very same listed here: Link Text

Hello gregor-pfeiffer.at Administrator, exact here: Link Text

Indihome Jakarta Timur sekarang ada dengan service pasang jaringan Indihome lewat cara online, anda tak

perlu hadir ke kantor indihome untuk kerjakan pendaftaran penempatan indihome.

Ini adalah wujud service digital paling depan dari Indihome Jakarta

Timur buat membantu orang Jakarta Timur yang ingin nikmati jaringan internet cepat indihome.

Dengan memakai Tehnologi Fiber Optik, kami menjajakan beberapa

service paket internet seperti Singgel Play, Dual Play namun juga

Triple Play. Tidak hanya itu kami tawarkan beberapa Add On Teratas buat anda

cicipi sama keluarga.

Ich habe hier große Artikel gefunden. Ich mag die Methode, die Sie schreiben. Gut!