In one of my previous blogs, I described the problems with analyzing financial statements of real estate companies. My central message was that purely quantitative earnings-based balance sheet analysis does not provide a robust indication of the value of the company and cash-oriented ratios, dividends and qualitative observations should be given preference.

Similar to my blog on construction companies, I now apply the suggestions I presented then to the semi-annual reports of Austria's listed real estate funds.

For this purpose, I compare some key figures with the performance on the stock market and interpret the correlation.

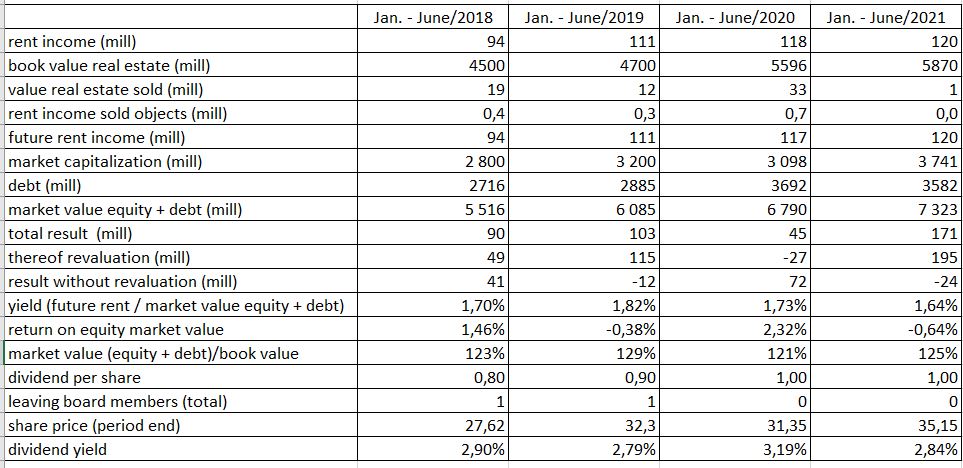

Ratios CA Immo AG, Source Basic Data: Vienna Stock Exchange Website

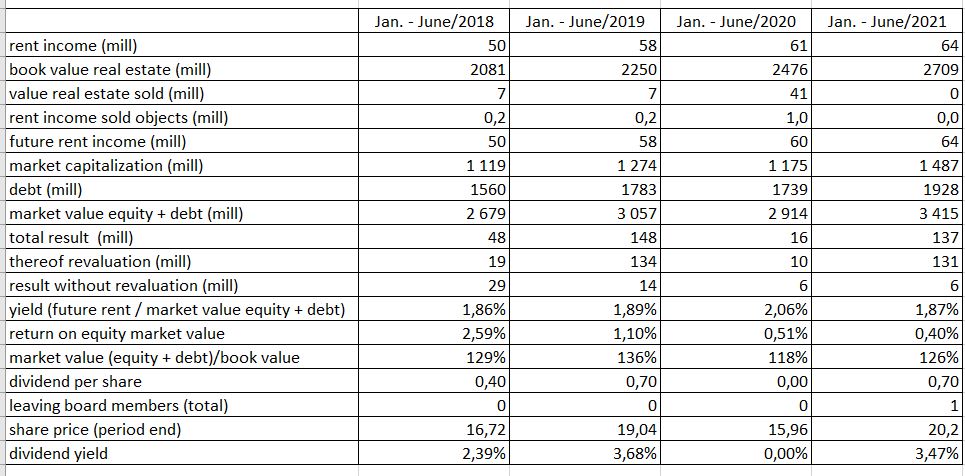

Ratios S Immo AG, Source Basic Data: Vienna Stock Exchange Website

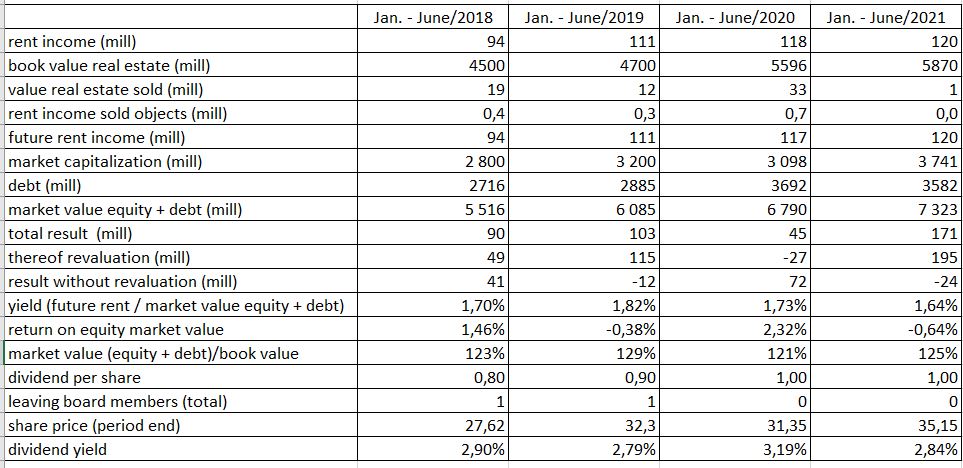

Ratios Immofinanz AG, Source Basic Data: Vienna Stock Exchange Website

Looking at the sets of key figures above, the following statements can be made:

- Compared to other shares, the fluctuation range of real estate shares is very low.

Immofinanz suffered the strongest loss in the observation period between HY 2019 and HY 2020 with around 50%. This is certainly painful for investors, but it roughly corresponds to the minus of the ATX. This shows that other stocks lost significantly more in the admittedly extraordinary comparison period.

- There is little correlation between earnings figures and share price

Looking at the above figures, it is confirmed that the market does not follow the results of any of the companies, neither with nor without taking into account the valuation result.

- Dividends are a (relatively) good indicator

Regarding dividends, it can be said that for Immofinanz and S Immo the years with the highest dividend yields were also the best for share prices. For CA Immo, dividend yields were more balanced, as was the share price. Thus, if one is forced to perform a quantitative company valuation, the use of a dividend discounting model seems to me advisable.

- A correlation between qualitative factors and share price is not discernible

In contrast to the construction companies, there is no discernible correlation between qualitative factors such as management changes or the message sent out and the share price. It is possible, however, that this is simply due to the public takeover battle that the companies have been fighting in recent years. It will be interesting to see how this issue develops in the coming years.

- A fundamental decoupling of book value and market value does not seem possible

I must admit that I was particularly puzzled by the narrow range of fluctuation from book to market value. For example, the ratio market value (defined as market capitalization + liabilities) / book value fluctuates de facto between 120% and 130% for all stocks during the observation period.

In summary, three key messages can be derived.

Firstly; if a company valuation is necessary, a dividend discounting model appears to be more practicable than a classic DCF method. Dividends provide a better basis for valuation than earnings.

Secondly; if it is purely an investment decision, the best strategy seems to be to wait until one of the real estate stocks has reached the lower end of the range and then to buy and sell again when it has reached the upper end.

Thirdly; the meaningfulness of real estate company financial statements remains very limited relative to financial statements in other industries.

Today, I went to the beachfront with my kids.

I found a sea shell and gave it to my 4 year old daughter and said „You can hear the ocean if you put this to your ear.“ She placed the shell to her ear

and screamed. There was a hermit crab inside and it pinched her ear.

She never wants to go back! LoL I know this

is totally off topic but I had to tell someone!

It’s actually a nice and helpful piece of info. I am happy that you simply shared

this useful info with us. Please keep us up to date like this.

Thank you for sharing.

I really like your blog.. very nice colors & theme. Did you make this website yourself or did you hire

someone to do it for you? Plz answer back as I’m looking to design my own blog and

would like to know where u got this from. cheers

Hello every one, here every one is sharing these know-how, thus

it’s pleasant to read this website, and I used to

pay a visit this web site every day.

Howdy! I know this is somewhat off topic but I was wondering which blog platform are

you using for this site? I’m getting tired of WordPress because I’ve had issues with hackers and I’m looking at options for

another platform. I would be great if you could point me in the direction of a good platform.

Dear gregor-pfeiffer.at administrator, You always provide great information and insights.

Dear gregor-pfeiffer.at admin, Thanks for the detailed post!

Hurrah! After all I got a web site from where I be able to truly get useful data concerning my study and knowledge.

I have been surfing online greater than three hours today, but I never found any interesting article like yours.

It is lovely worth enough for me. In my view, if all

website owners and bloggers made just right content material as you did, the internet

will be a lot more helpful than ever before.

Hi gregor-pfeiffer.at admin, Your posts are always well-delivered and engaging.

To the gregor-pfeiffer.at owner, Keep the good content coming!

Hello to all, the contents existing at this web

site are genuinely amazing for people knowledge, well, keep up the nice work fellows.

Wow, this paragraph is good, my younger sister is analyzing these kinds of

things, therefore I am going to tell her.

Hi! I know this is kind of off topic but I was wondering

which blog platform are you using for this website?

I’m getting sick and tired of WordPress because I’ve had problems with hackers and I’m looking at options for another platform.

I would be great if you could point me in the direction of a good platform.

I blog often and I really appreciate your content. The

article has truly peaked my interest. I am going to bookmark your blog

and keep checking for new details about once per week.

I opted in for your RSS feed as well.

Excellent goods from you, man. I’ve understand your stuff previous

to and you’re simply extremely magnificent. I really like what

you have got here, certainly like what you are stating and the way in which during

which you say it. You make it entertaining and you still

care for to keep it smart. I can not wait to read far more from you.

That is actually a tremendous site.

Dear gregor-pfeiffer.at owner, Your posts are always well-cited and reliable.

Hello gregor-pfeiffer.at admin, You always provide key takeaways and summaries.

Dear gregor-pfeiffer.at owner, Thanks for the comprehensive post!

To the gregor-pfeiffer.at administrator, Your posts are always well-received and appreciated.

Dear gregor-pfeiffer.at administrator, Great post!

Hello gregor-pfeiffer.at administrator, You always provide in-depth analysis and understanding.

To the gregor-pfeiffer.at webmaster, Well done!

To the gregor-pfeiffer.at webmaster, Your posts are always a great source of knowledge.

Dear gregor-pfeiffer.at admin, Your posts are always insightful and valuable.

To the gregor-pfeiffer.at admin, You always provide clear explanations and definitions.

Hi gregor-pfeiffer.at webmaster, You always provide valuable feedback and suggestions.

Dear gregor-pfeiffer.at owner, Thanks for the great post!

To the gregor-pfeiffer.at webmaster, Keep up the great work!

Dear gregor-pfeiffer.at admin, Thanks for the informative and well-written post!

Hi gregor-pfeiffer.at webmaster, Your posts are always well presented.

Hi gregor-pfeiffer.at owner, You always provide clear explanations and step-by-step instructions.

Dear gregor-pfeiffer.at admin, Your posts are always well-written and easy to understand.

To the gregor-pfeiffer.at administrator, Your posts are always well-received by the community.

To the gregor-pfeiffer.at owner, Thanks for the informative post!

Hi gregor-pfeiffer.at administrator, You always provide useful tips and best practices.

Hi gregor-pfeiffer.at administrator, Your posts are always well-referenced and credible.

To the gregor-pfeiffer.at webmaster, You always provide practical solutions and recommendations.

Hi gregor-pfeiffer.at webmaster, You always provide great examples and real-world applications.

Hi gregor-pfeiffer.at administrator, Your posts are always well-structured and logical.

Hello gregor-pfeiffer.at webmaster, Your posts are always well researched and well written.

Hello gregor-pfeiffer.at owner, Thanks for the in-depth post!

Hello gregor-pfeiffer.at webmaster, Your posts are always well-structured and logical.

To the gregor-pfeiffer.at owner, Thanks for the valuable information!

Hi gregor-pfeiffer.at administrator, Good work!

Dear gregor-pfeiffer.at administrator, Your posts are always insightful and valuable.

Hi gregor-pfeiffer.at administrator, Thanks for the well-organized and comprehensive post!

Hi gregor-pfeiffer.at owner, Thanks for the informative and well-written post!

Hello gregor-pfeiffer.at admin, Thanks for the well-researched and well-written post!

Hi gregor-pfeiffer.at admin, Thanks for the well-researched and well-written post!

Dear gregor-pfeiffer.at webmaster, Thanks for the well written post!

To the gregor-pfeiffer.at webmaster, Your posts are always well-referenced and credible.

To the gregor-pfeiffer.at administrator, Great job!

Hello gregor-pfeiffer.at administrator, Keep up the good work, admin!

Hi gregor-pfeiffer.at owner, Your posts are always well researched.

Hello gregor-pfeiffer.at administrator, Your posts are always well-written and easy to understand.

Hi gregor-pfeiffer.at webmaster, Your posts are always well-balanced and objective.