In one of my previous blogs, I described the problems with analyzing financial statements of construction companies. My central message was that purely quantitative earnings-based balance sheet analysis does not provide a robust indication of the value of the company, and that preference should instead be given to longer-term dividend trends and qualitative observations such as management changes.

As the half-year reporting season has just come to an end, I decided to do a practical test of Austria's listed construction companies.

For this purpose, I compare some key figures with the performance on the stock market and interpret the correlation.

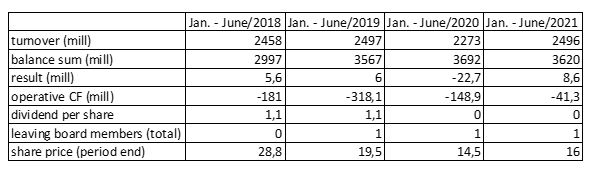

Graph: Selected Ratios PORR AG (Source: Vienna Stock Exchange)

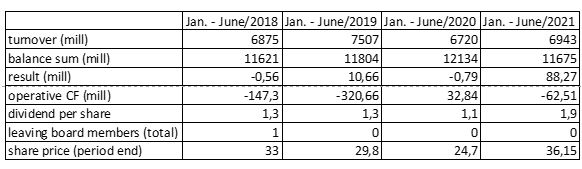

Graph: Selected Ratios Strabag AG (Source: Vienna Stock Exchange)

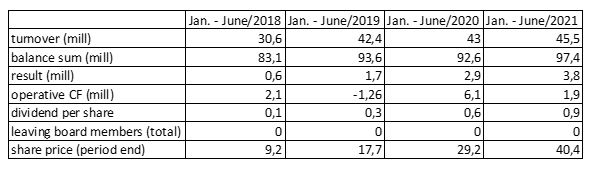

Graph: Selected Ratios SW Umwelttechnik AG (Source: Vienna Stock Exchange)

Looking at the sets of key figures above, the following statements can be made:

- The correlation between earnings and share price is very weak

Among the three construction companies listed at Vienna Stock Exchange, only SW Umwelttechnik shows a more or less constant price/earnings ratio. In the case of Strabag and PORR, the only observable correlation is that share price and earnings both fell in H1 2020, as a result of the corona pandemic, and rose again in the following year.

- Dividend payments have more significance

For all companies and in almost all years, a relation between dividend payout and share price can be observed. The relationship is relatively weakest at PORR, but even here it is clear that years without dividends are not good for the share price.

- Qualitative factors and the "story" make the difference

If we look at the financial statements of the three companies, we see that Strabag and SW Umwelttechnik place a strong emphasis on continuity. In simple terms, the message can be summed up as "we have found our way and are simply following it consistently". As a result, there is no reason for personnel changes. The message from PORR is rather "we see potential in many places and therefore want to improve continuously through change".

The interpretation of the messages is certainly subjective to a certain extent and a priori (at least to me) both messages seem to have their justification. If you look at the personnel departures at board level, they are in line with the respective message. SW Umwelttechnik, for example, had no changes on the board during the period under review, while Strabag had one change due to retirement. The comparative value at PORR, on the other hand, was higher.

The cause/effect could be discussed in detail, and some personnel changes may also be due to external factors, but qualitative factors such as stability and message seem to have an impact on the value of the company.

In sum, I stand by three statements.

First, the meaningfulness of (semi-)annual financial statements in the construction business is very limited.

Second; a continuous dividend development is the most reliable quantitative factor.

Thirdly, a qualitative analysis of the long-term development of the company and the messages communicated does no harm in any industry, but it should be given particular weight in the construction sector.

Yoou nsed to take paret inn a contet for onee off tthe greatest sitess

on the internet. I most certaainly will recommmend this website!

Hello gregor-pfeiffer.at owner, You always provide great resources and references.

Dear gregor-pfeiffer.at administrator, Keep up the great work!

Hello gregor-pfeiffer.at webmaster, Your posts are always well written.

Hi gregor-pfeiffer.at admin, Your posts are always well-referenced and credible.

Hi gregor-pfeiffer.at administrator, You always provide helpful diagrams and illustrations.

Dear gregor-pfeiffer.at webmaster, Your posts are always well thought out.

Hi gregor-pfeiffer.at administrator, Thanks for the well-researched and well-written post!

Hello gregor-pfeiffer.at webmaster, Your posts are always on topic and relevant.

Hi gregor-pfeiffer.at webmaster, Your posts are always well-cited and reliable.

Hello gregor-pfeiffer.at admin, Your posts are always well-referenced and credible.

To the gregor-pfeiffer.at administrator, Your posts are always well-supported by facts and figures.

Hi gregor-pfeiffer.at webmaster, You always provide great examples and case studies.

To the gregor-pfeiffer.at admin, Your posts are always well received by the community.

To the gregor-pfeiffer.at admin, Your posts are always a great source of knowledge.

Hello gregor-pfeiffer.at administrator, You always provide clear explanations and step-by-step instructions.

Dear gregor-pfeiffer.at owner, Thanks for the well written post!

Hello gregor-pfeiffer.at admin, Keep the good content coming!

Hello gregor-pfeiffer.at administrator, Your posts are always well-written and easy to understand.

Hello gregor-pfeiffer.at owner, You always provide great resources and references.

Hi gregor-pfeiffer.at webmaster, Thanks for the well-structured and well-presented post!

Hello gregor-pfeiffer.at webmaster, Your posts are always insightful and valuable.

Dear gregor-pfeiffer.at webmaster, Your posts are always well written and informative.

To the gregor-pfeiffer.at administrator, Your posts are always well-supported by research and data.

Hello gregor-pfeiffer.at administrator, Good to see your posts!

Hi gregor-pfeiffer.at administrator, You always provide great examples and real-world applications, thank you for your valuable contributions.

Hi gregor-pfeiffer.at admin, Thanks for the post!

To the gregor-pfeiffer.at administrator, Thanks for the well-structured and well-presented post!

Hi gregor-pfeiffer.at admin, Your posts are always well-supported by facts and figures.

Hello gregor-pfeiffer.at admin, Good to see your posts!

Hello gregor-pfeiffer.at webmaster, You always provide practical solutions and recommendations.

Hello gregor-pfeiffer.at admin, You always provide practical solutions and recommendations.

Hello gregor-pfeiffer.at webmaster, Keep sharing your knowledge!

Dear gregor-pfeiffer.at owner, You always provide useful tips and best practices.

To the gregor-pfeiffer.at owner, Your posts are always informative and well-explained.

To the gregor-pfeiffer.at admin, Your posts are always a great source of knowledge.

Hello gregor-pfeiffer.at administrator, Well done!

Dear gregor-pfeiffer.at admin, You always provide valuable feedback and suggestions.

Hi gregor-pfeiffer.at webmaster, Thanks for the in-depth post!

Hi gregor-pfeiffer.at owner, You always provide valuable information.

Dear gregor-pfeiffer.at admin, Thanks for the detailed post!

Hello gregor-pfeiffer.at administrator, Your posts are always well written and informative.

Dear gregor-pfeiffer.at administrator, Keep up the good work!

To the gregor-pfeiffer.at admin, Thanks for the detailed post!

Dear gregor-pfeiffer.at administrator, Thanks for the post!

Dear gregor-pfeiffer.at webmaster, Keep up the good work!

To the gregor-pfeiffer.at administrator, You always provide clear explanations and definitions.

Hi gregor-pfeiffer.at webmaster, Thanks for the informative post!

To the gregor-pfeiffer.at webmaster, Your posts are always informative and up-to-date.

Hi gregor-pfeiffer.at webmaster, Well done!

Dear gregor-pfeiffer.at webmaster, Your posts are always insightful and valuable.

Dear gregor-pfeiffer.at administrator, Your posts are always on point.

Hi gregor-pfeiffer.at admin, Your posts are always well researched and well written.

To the gregor-pfeiffer.at admin, Thanks for sharing your thoughts!

Dear gregor-pfeiffer.at admin, Your posts are always a great source of knowledge.

Dear gregor-pfeiffer.at admin, You always provide in-depth analysis and understanding.

Dear gregor-pfeiffer.at admin, You always provide valuable feedback and suggestions.

Hello gregor-pfeiffer.at admin, You always provide great examples and real-world applications.

Dear gregor-pfeiffer.at webmaster, Your posts are always well received by the community.

Hi gregor-pfeiffer.at Webmaster, identical below: Link Text

To the gregor-pfeiffer.at Admin, identical below: Link Text

Hi gregor-pfeiffer.at Webmaster, same right here: Link Text