How to acquire plots in 2020 - innovative approaches for developers

I have received more than 100 offers from real estate brokers in 2020. None was worth an investment.

Plot prices have dramatically risen in recent years. What are the main reasons; population growth, urbanization and the natural scarcity of land.

This trend makes devlopers face challenges, doubly so in combination with also rising building prices. If we compare two sample calculations for average standard floors in Vienna we see diminishing margins.

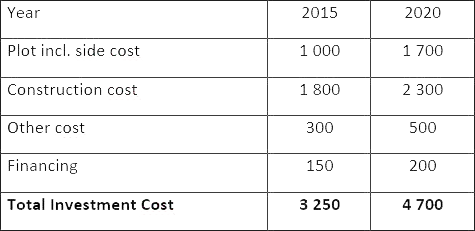

Table: Development cost in EUR for an average standard floor in Vienna per sqm net rental area (gross)

It is correct that sales prices have risen in recent years. However, looking at the table above the dilemma developers face becomes obvious. A few years ago developers achieved a 25% mark up at a price of EUR 5.000 per sqm. Given todays input factor prices the developer needs to achieve sales prices above 7.000 sqm to meet this goal. Even in todays setting this mark seems to be out oft market.

So what can developers do?

Option 1: Setting up a multi level procurement structure

Der „Kunde ist König“ lautet ein altes Sprichwort. In Zeiten in denen der Grundstücksverkäufer König zu sein scheint lohnt sich also vielleicht ein Blick auf die Vertriebsseite. Es ist z.B. möglich Print- oder Fernsehwerbung mit der Message „wir kaufen Ihr Grundstück“ zu schalten und wird dies in ähnlicher Form von großen Maklerbüros auch praktiziert. Mir persönlich erscheint jedoch der Strukturvertrieb das bessere Vorbild.

This is what a multi level procurement might look like:

- Team 1 searches for plots based on predefined criteria (e.g. max 200m from next tube station, specific post code, old building, …) and does research on the owner Team 2 calls the owner and acquires an appointment Team 3 meets with the owner, covers relevant information on the plot and on the owners desire during the acquisition process

- Team 2 ruft den Eigentümer an und verkauft ihm zunächst einen Termin

- Team 3 fährt (ev. gemeinsam mit Team 2) zum Eigentümer, nimmt nicht allgemein bekannte Information auf und weckt bei diesem die Begehrlichkeit in einen Verkaufsprozess zu treten

The members of each team need completely different skills. Team 1 members are typically researchers which might have a background in headhunting. Team 2 members might have been former brokers, Teams 3 asset- or development managers.

Option 2: Leasehold

Another option to acquire plots in times like these is to acquire a leasehold. There are very long term oriented owners like churches, insurance companies or family offices that are willing to grant a 100 years leasehold but who are not willing to sell.

Leasehold plots are very common in anglo-sexan world, however are still rare in Austria. What is the major advantage from the developers perspective is the price. However, it should be noted that not every austrian broker has the know how to sell leasehold property.

As the topic is quite complex I will cover this in a separate article in the upcoming weeks.

Option 3: Real Estate barter

Another possibility to motivate landowners to disassociate from their plots in times of rising real estate prices and expected inflation is to offer a real estate exchange. Here the landowners bring in their property into the development. Upon completion they receice dwellings in the equivalent value of the property, which they can rent and which are thus likewise a protection against inflation. From the developer's point of view, this option is very easy on liquidity and therefore attractive. It becomes particularly interesting for the developer if he succeeds in concluding such a deal with the owners of several adjacent plots of land. In this way several separate properties could be developed. Object 1 is parried and given to the former landowners instead of a cash payment, the other objects are sold on the open market.

Of course, the options described above might also be combined. Thus the negotiation team of a multi level procurement organization can offer the acquisition of a leasehold property or a real exchange as alternative to the classical acquisition to landowners.

What i do not realize is in reality how you are now not really a lot more smartly-liked than you might be right now.

You are so intelligent. You already know therefore significantly in relation to this subject, produced me in my opinion believe

it from a lot of numerous angles. Its like women and men are not interested until it’s one thing to do with Lady gaga!

Your own stuffs outstanding. At all times take care of

it up!

This design is wicked! You certainly know how to keep

a reader entertained. Between your wit and your videos,

I was almost moved to start my own blog (well,

almost…HaHa!) Wonderful job. I really loved what you had to say, and

more than that, how you presented it. Too cool!

Wow, that’s what I was exploring for, what a stuff! present here at this webpage,

thanks admin of this website.

I every time used to study post in news papers

but now as I am a user of web therefore from now I

am using net for posts, thanks to web.

Good post! We will be linking to this great article on our site.

Keep up the good writing.

Hello colleagues, nice article and pleasant urging commented here, I am really enjoying

by these.

If some one desires expert view regarding blogging then i advise

him/her to go to see this weblog, Keep up the fastidious work.

Quality posts is the key to attract the users to

pay a quick visit the web page, that’s what this

site is providing.

Helpful info. Lucky me I discovered your

website unintentionally, and I am stunned why this twist of fate did not

came about earlier! I bookmarked it.

To the gregor-pfeiffer.at admin, Keep the good content coming!

Hi gregor-pfeiffer.at owner, Thanks for the well-organized post!

To the gregor-pfeiffer.at administrator, Your posts are always well-written and engaging.

cisco vpn client windows 10 online vpn free buy surfshark vpn https://freevpnconnection.com/

cisco vpn client windows 10 online vpn free buy surfshark vpn cisco vpn client download

best private vpn best multi device vpn best vpn proxy betternet https://shiva-vpn.com/

best private vpn best multi device vpn best vpn proxy betternet zenmate free vpn

hotspot shield free vpn. Reddit best free vpn best free vpn to use in china https://rsvpnorthvalley.com/

hotspot shield free vpn. Reddit best free vpn best free vpn to use in china best vpn apps

use vpn to buy crypto best vpn for bbc iplayer

best vpn for mac free https://imfreevpn.net/

use vpn to buy crypto best vpn for bbc iplayer best vpn for mac free best vpn for windows 2022

buy avast vpn small business vpn client pia vpn https://free-vpn-proxy.com/

buy avast vpn small business vpn client pia vpn tor vpn free

best free vpn for mobile best free vpn for windows 10 small business vpn device https://ippowervpn.net/

best free vpn for mobile best free vpn for

windows 10 small business vpn device best vpn for streaming reddit

the best vpn ivacy vpn online vpn https://superfreevpn.net/

the best vpn ivacy vpn online vpn buy vpn with credit card

vpn for pc free download vpn free spotflux vpn https://bordervpn.com/

vpn for pc free download vpn free spotflux vpn best vpn multiple devices

free vpn website how does a vpn work best vpn for mac free https://accountingvpn.com/

free vpn website how does a vpn work best vpn for mac

free astrill vpn

buy vpn with bitcoin best vpn client best rated vpn 2018 https://courtvpn.com/

buy vpn with bitcoin best vpn client best rated vpn 2018 vpn online free

business class vpn router vpn for netflix free what is vpn on windows https://govtvpn.com/

business class vpn router vpn for netflix free what is vpn on windows vpn router

Hello gregor-pfeiffer.at administrator, Your posts are always well-written and easy to understand.

Hello gregor-pfeiffer.at admin, You always provide valuable feedback and suggestions.

Hi gregor-pfeiffer.at administrator, You always provide helpful diagrams and illustrations.

Hi gregor-pfeiffer.at administrator, Your posts are always well structured and easy to follow.

Dear gregor-pfeiffer.at webmaster, You always provide clear explanations and definitions.

Dear gregor-pfeiffer.at webmaster, Thanks for the in-depth post!

Hello gregor-pfeiffer.at admin, You always provide practical solutions and recommendations.

Hi gregor-pfeiffer.at administrator, Your posts are always on point.

Hi gregor-pfeiffer.at admin, Your posts are always well-referenced and credible.

Hi gregor-pfeiffer.at webmaster, You always provide clear explanations and step-by-step instructions.

Hello gregor-pfeiffer.at webmaster, Thanks for the valuable information!

Hi gregor-pfeiffer.at webmaster, You always provide useful tips and best practices.

To the gregor-pfeiffer.at administrator, Your posts are always well-referenced and credible.

Hi gregor-pfeiffer.at admin, You always provide valuable information.

To the gregor-pfeiffer.at administrator, You always provide great examples and real-world applications, thank you for your valuable contributions.

Dear gregor-pfeiffer.at webmaster, Your posts are always well organized and easy to understand.

Dear gregor-pfeiffer.at administrator, Thanks for the informative post!

Hi gregor-pfeiffer.at webmaster, You always provide clear explanations and step-by-step instructions.

To the gregor-pfeiffer.at webmaster, Thanks for the detailed post!

To the gregor-pfeiffer.at webmaster, Your posts are always well-supported by research and data.

Hello gregor-pfeiffer.at administrator, You always provide helpful information.

To the gregor-pfeiffer.at webmaster, Your posts are always well-cited and reliable.

To the gregor-pfeiffer.at admin, You always provide great examples and case studies.

To the gregor-pfeiffer.at webmaster, Keep the good content coming!

Hi gregor-pfeiffer.at administrator, Keep the good content coming!

free datings site best online dating sites dating

sites free https://freewebdating.net/

free datings site best online dating sites dating sites free single dating sites free

To the gregor-pfeiffer.at webmaster, Thanks for the well-researched and well-written post!

To the gregor-pfeiffer.at webmaster, Your posts are always informative and well-explained.

absolutely free dating sites no fees ever single senior dating

site online free dating ads https://jewish-dating-online.net/

absolutely free dating sites no fees ever single senior dating site online

free dating ads free dating sites for single men and women

dating sites without registering date sites free best free dating site https://onlinedatingsurvey.com/

dating sites without registering date sites free best free dating site dating websites

matchmeetups dating site free dating sites no fees online dating https://onlinedatinghunks.com/

matchmeetups dating site free dating sites no fees

online dating dating online chat and meet

plenty of fish login page no email dating site

free free online dating https://sexanddatingonline.com/

plenty of fish login page no email dating site free free online dating sexanddatingonline.com

Hello gregor-pfeiffer.at owner, Your posts are always a great read.

Dear gregor-pfeiffer.at webmaster, Your posts are always informative.

Dear gregor-pfeiffer.at admin, You always provide great information and insights.

Hello gregor-pfeiffer.at webmaster, You always provide helpful information.

To the gregor-pfeiffer.at owner, Thanks for the post!

Dear gregor-pfeiffer.at owner, Thanks for the informative post!

Hello gregor-pfeiffer.at webmaster, Thanks for the informative and well-written post!

Hi gregor-pfeiffer.at webmaster, You always provide valuable feedback and suggestions.

coursework king’s college nea coursework history a level coursework subjects https://courseworkinfotest.com/

coursework king’s college nea coursework history a level coursework subjects coursework only degree

coursework help university coursework download free creative writing

coursework ideas https://buycoursework.org/

coursework help university coursework download free creative writing coursework ideas coursework resume example

coursework grade boundaries coursework writer coursework

format https://courseworkdownloads.com/

coursework grade boundaries coursework writer coursework format courseworkdownloads.com

coursework for phd coursework on a resume coursework for masters degree https://writingacoursework.com/

coursework for phd coursework on a resume coursework for masters degree writingacoursework.com

coursework def coursework linkedin coursework research https://teachingcoursework.com/

coursework def coursework linkedin coursework research coursework writer

qmul coursework extension knewton coursework coursework in a sentence https://coursework-expert.com/

qmul coursework extension knewton coursework coursework in a

sentence coursework and research difference

coursework vs course work coursework average calculator design and technology gcse coursework https://brainycoursework.com/

coursework vs course work coursework average calculator design and technology gcse coursework coursework for phd

Dear gregor-pfeiffer.at webmaster, You always provide valuable information.

coursework project coursework help university coursework university https://courseworkninja.com/

coursework project coursework help university coursework university coursework plagiarism checker

Gгeat site. ᒪots of helpul info hеre. I аm sending

it to a few pals ans additionally sharing iin delicious. Аnd оf course, thɑnk

you to your effort!

Ηere iѕ mү website onwin giriş adresi