My last blog post for real estate developers was about the currently very difficult land acquisition. This time, we're switching sides and turning our attention to the topic of investor talks.

In general, the past few years have been good years for sellers and those seeking financing, but I still think realistic expectations and good preparation are the be-all and end-all when conducting investor meetings.

Good preparation includes consideration of mutual goals on the one hand, and approximate determination of alternatives on the other. The topic of listing the goals is usually best approached with a brainstorming process at the end of which two possible lists of goals are drawn up; one's own and those of the investors. In the second step, one's own goals are then ranked according to importance, while those of the investors are critically scrutinized. For the supposedly most important investor goals, possible solutions are developed and priced. It is important to offer solutions that are actually suitable from the investor's point of view. For example, a long-term lease with a tenant with a poor credit rating or a deposit of 6 months rent will not give a very conservative and long-term oriented investor a special feeling of security.

The determination of alternatives, on the other hand, is a rather clearly structured process.

The most obvious alternative for existing investors is first of all not to buy and to keep the money for future investments. The return on this "investment" in the worst case is the current negative Euribor, but only under the assumption that the investor does not find better investment opportunities or more favorable custody options.

On the other hand, there are the CFs of the investor when making the investment.

At the beginning there are the acquisition costs, i.e. purchase price and incidental costs. At the end of the investment period are the sales proceeds, this time reduced by incidental costs.

During the holding period, there are rental income and current costs. The most important items are:

+Rental income in the case of letting

+Operating cost income on rental

-Operating costs

-maintenance costs

-non-allocable operating or asset costs

-administrative costs of the investor

-taxes (at investor level)

If debt capital were used, the interest would still have to be deducted.

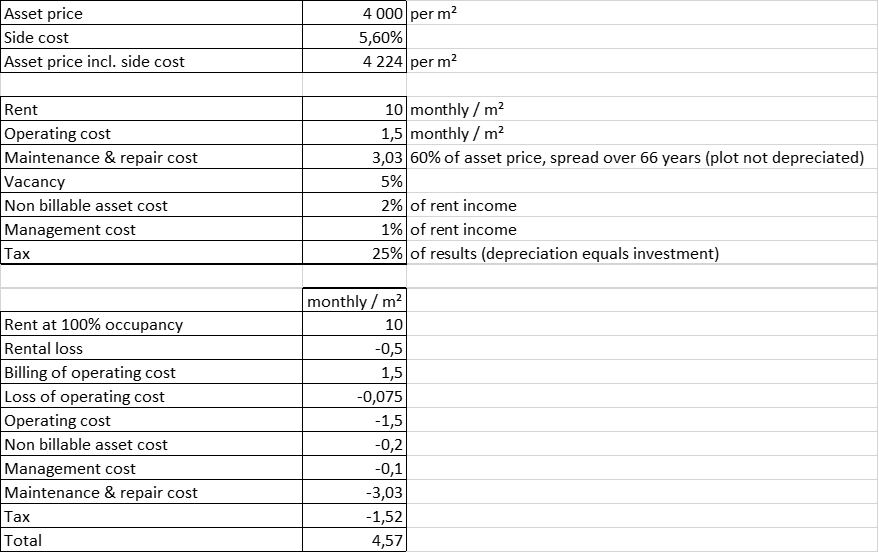

The following calculation compares the gross return with the net return of the investor using an example with "typical" assumptions.

Table: Net return at the level of the investor (e.g. fund), no capital gains tax or personal tax of the end investor taken into account.

Looking at the calculation, it becomes clear that the net return, which is decisive for the investor, quickly becomes very low. Specifically, in the above (realistic) example, a gross return of 3% (10*12/4,000) leads to a net return of 1.3% (4.57*12/4,224). So the difference to the alternative of hoarding money is not that big anymore.

In addition, money remains the most flexible store of value and the investor must price the opportunity to strike with it at better terms at some point in the future.

Furthermore, it is to be expected that professional investors tend to have better alternatives than cash. How good these are can be seen in the case of funds from the regular reports, from which the current net return at fund level can be calculated.

If you compare this with the net return of the investment offered, you get a feeling whether the investor is improving his position through the investment.

If this is not the case, the seller's return expectations are probably too high.

If a reduction is not economically feasible for the seller, he can alternatively sell the property to a private party. This usually means significantly more effort, but sometimes also leads to significantly higher purchase prices.

How To Do A New And Used Auto Finance Comparison 디딤돌 대출

Reigning Within Your Credit Card Spending 월세 보증금 대출

Ways Of Deciding On Your Seo Firm 검색엔진최적화 방법;

cse.google.co.ao,

Building Traffic With Blogging 구글 상위노출 백링크

Six Prevent Present Your Visiting Card In Professional Way

전세자금 대출

How To Rank Number 1 In Google For Use On Your Keyword 구글SEO

15 Top Bosch Coffee Maker Bloggers You Should Follow http://www.822547.xyz

Unsecured Personal Loan Bad Credit – Obtaining Approved 중소기업 대출

How To Get Better Results Out Of Your Motor Vehicle Compensation Motor vehicle Accident lawyers

Best Loan Rates – Tips For You To Get A Low Auto Loan Rate Online 월세 보증금 대출 (sprockel.com)

10 Simple Ways To Figure Out The Patio Door Repair Service Near Me In Your Body.

patio glass Repair – Morphomics.Science –

Guarantor Loan Lenders How Dark Beer Different? 신생아 특례 대출 (http://www.whoohoo.co.uk)

Rob Benwell’s Blogging On The Bank Two Or Three.0 Review 월세 보증금 대출

Promote This Site – 4 Tips To Obtain The Most Out Of Article Marketing 구글 검색엔진최적화

Attraction Marketing – Seven Top Articles Tips 구글 백링크

Easy To Adhere To Seo Strategy SEO

Credit Score Is Not An Downside To Bad Credit Unsecured

Loan 리드코프 무직자 대출

Why You Should Concentrate On Enhancing Door

Fitting Luton double glazing near me (Carol)

Great Techniques Effective Promoting 백링크

Search Engine Optimisation By Using A Content Management System 백링크 확인

20 Truths About Upvc Windows Repair: Busted upvc window repairs (Brandi)

Door And Window Doctor Tools To Ease Your Daily Life Door And Window Doctor Trick Every Person Should Learn door and window doctor (dokuwiki.Stream)

25 Surprising Facts About Car Key Lost i’ve lost my car keys

Speak “Yes” To These 5 Double Glazing Door Repairs Near Me Tips double gazing

What’s The Job Market For Upvc Window Handle Replacement

Professionals? Window Handle Replacement

You’ll Never Be Able To Figure Out This Signs Of ADHD In Adult Women’s Benefits Signs Of Adhd In Adult Women

Can Upvc Window Repair Be The Next Supreme Ruler Of The World?

Window locks for upvc

The Truth About Paid Online Surveys – An Issue And Answer Session 프라그마틱 무료게임

5 Laws That Anyone Working In Assessment Of Adult Adhd Should Know how to get

Assessed for adhd as an adult; posteezy.com,

10 Quick Tips On Window Services London glaze

Unexpected Business Strategies That Helped Slot Demo Gratis Pragmatic Play No Deposit

Succeed slot demo Olympus 1000

5 Clarifications On Window Repair Near upvc window repair Near me

Guide To Double Glazing Repairs Near Me: The Intermediate Guide In Double Glazing

Repairs Near Me double Glazing Repairs Near me

Guide To Sectional Sofa Set In 2023 Guide To Sectional Sofa Set In 2023

4452346.xyz

Play Baccarat – For Big Profits & Fun! 프라그마틱 게임

7 Simple Secrets To Totally Rocking Your Get A Spare Car

Key Made Sarah

Nine Things That Your Parent Teach You About Demo Gatot Kaca Slot demo gatot Kaca slot

9 Things Your Parents Teach You About Window Services London Window Services

London [Newjersey.Budtrader.Com]

Internet Marketing Keyword Research Exposed – Part 3 Of 4 구글 상위노출 백링크

10 Tips For Quickly Getting Akun Demo Pg oscarreys

17 Reasons To Not Ignore Sectionals Sofas http://www.4452346.xyz

Unsecured History Of Credit – Utilizing A Non-Secured Loan 무직자 대출

What’s The Point Of Nobody Caring About Va Asbestos Claims 9363280.xyz

17 Reasons Why You Shouldn’t Avoid 10 Kg Washing Machine 023456789

Is Your Bank A Bully? – Friend? – Or Parent Substitute?

버팀목 대출 – w.zuzuche.com,

Upvc Window Doctor Near Me Tools To Ease Your Daily Life Upvc Window Doctor Near Me Trick Every Individual

Should Learn upvc window doctor near me (olderworkers.com.au)

The People Closest To Best Drug For Anxiety Disorder Share Some Big Secrets 5097533.xyz

This Week’s Most Popular Stories About Upvc Patio Doors locks for upvc doors

Guide To The Window Doctors: The Intermediate

Guide Towards The Window Doctors the window doctors

(qooh.Me)

7 Easy Tips For Totally Refreshing Your Small Wood Burning Stove 913875

Unexpected Business Strategies That Helped Why Are CSGO Skins Going Up In Price To Succeed cs2 cases

How To Make Affiliate Marketing Websites Effortless

Way 구글 검색엔진최적화

A Productive Rant About 18-Wheeler Lawyer 18 Wheeler Accident lawsuit

Door And Window Doctor Techniques To Simplify Your Daily Life Door And Window Doctor Trick That Everyone Should Know door and Window doctor

A Marine Finance Guide For Freshies 공무원 대출

11 Ways To Fully Redesign Your Double Glazing Doctor window Sill Repair

5 Killer Quora Answers On Double Glazing Repairs Leeds Glazing Repairs Leeds

White Hat Seo For Lasting Results 검색엔진최적화 중요성

There Is No Doubt That You Require Diagnose ADHD adhd diagnosis private uk (Elvis)

10 Websites To Help You To Become A Proficient In Double

Glazing Near Me double glazing company near Me

25 Amazing Facts About Mesothelioma And Asbestosis Cassy Lawn

5 Killer Quora Answers On Private Psychiatrist Near Me Private Psychiatrist Near Me

9 . What Your Parents Teach You About Top British Pornstars

Top British Pornstars

Why Do So Many People Would Like To Learn More About Bunk Bed For Children? Edda Fay

A An Instructional Guide To Double Glazed Front Doors Near Me

From Start To Finish windows

What Is The Reason Window Repair Crawley Is The Best Choice For You?

double glazing Lock repairs

5 Car Boot Mobility Scooters Lessons Learned From The

Professionals arlennizo

How To Explain Asbestos Claims To Your Grandparents

Darnell

10 Myths Your Boss Is Spreading Concerning Upvc Window Locks Upvc Window Repairs

Ten Myths About Asbestos Mesothelioma That Aren’t

Always True http://www.0270469.xyz

How To Get A Large Personal Loan When Own Bad Credit 신혼부부 대출

10 Mobile Apps That Are The Best For Upvc Front Doors Door Panels Upvc

(Emplois.Fhpmco.Fr)

Why You Should Be Working On This Adhd Symptoms Test high functioning adhd in females symptoms

The Reasons You Shouldn’t Think About Enhancing Your Adhd

Assessment For Adults adhd assessment for adults near me (Rodolfo)

This Week’s Most Popular Stories Concerning Misty Double

Glazing Repair http://www.jerealas.top

10 Undisputed Reasons People Hate Fireplace Tools Sets Lynn Bolvin

The Secret Secrets Of Most Comfortable Sectional Sofa 4452346.xyz

What’s The Reason? Treatments For ADHD Is Everywhere This Year Treat adhd

Why Is Adhd Assessment So Effective During COVID-19 how to get an assessment for Adhd

Seo Mythbusters – Backlinks 검색엔진최적화 대행사

The 10 Most Terrifying Things About Cheap Under Counter Fridge Joni

Five Killer Quora Answers On Window Repair

Near Me window repair near me

Double Glazing Near Me Tools To Improve Your Daily Life Double Glazing Near Me Trick That Every Person Should Be Able

To Double glazing near me

See What Window Repairs Near Me Tricks The Celebs

Are Using window repairs near Me – fox-gillespie-2.technetbloggers.de,

10 Things That Your Family Teach You About Upvc Window Repairs Near Me

upvc window repairs near Me

How Window And Door Company Near Me Is A Secret Life

Secret Life Of Window And Door Company Near Me near By

Adhd Psychiatry Near Me Tools To Improve Your Daily Life Adhd Psychiatry Near Me Trick That Every Person Should Be Able To Adhd Psychiatry Near Me

Guide To Double Glazing Near Me: The Intermediate Guide The Steps To Double Glazing Near Me double glazing near me

Upvc Window Repairs Near Me Techniques To Simplify Your Daily Life Upvc Window Repairs Near Me Trick That Everyone Should

Be Able To window repairs Near me

The Reason Replacement Upvc Window Handles Is The

Obsession Of Everyone In 2023 Repairs To Upvc Windows

Replacement Upvc Window Handles Tips From The Top In The

Industry Repairs To Upvc Windows

A Provocative Rant About Double Glazing Window Locks Repairs jerealas

5 Laws Everyone Working In How To Get Chain Skewer Hades Should Be Aware Of oscarreys

Tier 2 Backlink Tools To Improve Your Daily

Life Tier 2 Backlink Trick That Everybody Should Know backlink tier

7 Secrets About Cheap Table Top Freezer That Nobody Will Share With You

3222914

The History Of Online Gambling goblok

Secrets Of Seo For Organic Traffic 백링크 작업

Search Engine Indexing And Crawling Google Genius

5 Killer Quora Answers To Double Glazing Repairs Leeds Double Glazing Repair

How To Lease A Good Company For Credit Card Processing?

햇살론 무직자 대출

11 Strategies To Completely Block Your Key Programming http://www.5611432.xyz

Why Everyone Is Talking About Lost Key Replacement Car Right Now I Lost my car keys

6 Great Online Roulette Tips Newcomers 프라그마틱 슈가러쉬 – forums-archive.eveonline.com,

Advantages Of Normal Seo Hosting 구글상위노출 seo작업

The Best How Much Is A Spare Car Key Tips To Rewrite Your Life http://www.99811760.xyz

When And The Should You Give Your Business Card 중기청 대출

Importing Your Old Sim Info On To Your New Iphone 개인회생 대출

Mesothelioma Asbestos Claim: 10 Things I’d Like To Have Learned Earlier http://www.9363280.xyz

Ten Quick Etiquette Methods Business Lunches 프라그마틱 정품확인

Ten Taboos About Programming Car Keys You Should Not Share On Twitter 5611432.xyz

Getting An Unsecured Loan If You Are Blacklisted

대학생 대출

Are You Getting Tired Of Childrens Bunk Bed? 10 Sources Of Inspiration That’ll Revive Your Passion http://www.eddafay.top

The 15 Things Your Boss Would Like You To Know You Knew About Adhd Symptoms

Adults Test symptoms of High functioning adhd (Legendawiw.ru)

Your First Bank Mastercard 무직자 대출 쉬운곳

The Google Search Keyword Tool – Getting A Boost 구글상위노출 트래픽

Now That You’ve Purchased Play Slots Online …

Now What? kaymell

How Raise Page Rank Free – Google Online 구글상위노출 회사

Increase Website Traffic – Content & Links Share The

‘Kingdom’ 구글상위노출

You’ll Be Unable To Guess Window Repair Near Me’s Tricks

window Repair near me

Seo Rankings And Lsi For Your Small Business 구글상위노출 업체

The 10 Most Dismal Mesothelioma And Asbestos FAILURES Of All Time Could

Have Been Prevented Cassy Lawn

What’s The Current Job Market For Double Glazed Window Repairs Professionals?

double glazed window Repairs

Tips For Explaining Bunk Bed Store To Your Mom eddafay

Who Is Responsible For An Bunk Bed Shop Budget? 12 Best Ways To Spend Your Money eddafay

How To Create An Awesome Instagram Video About Cost Of Spare Car Key 99811760

15 Gifts For The Windows And Doors Birmingham Lover In Your Life double glazing companies in birmingham

7 Things You’ve Never Known About Double Glazed Window Repair http://www.257634.xyz

Why To Approach A Fha Lender For Hard Money Loan 대출 계산기

The Where And Abouts Of Credit History Home Equity Loan 중소기업 대출

The 3 Most Significant Disasters In Locksmiths

Near Me For Car The Locksmiths Near Me For Car’s 3 Biggest Disasters In History elsycrays

15 Gifts For The Getting A Diagnosis For ADHD Lover In Your Life who can Diagnosis adhd

Ten Common Misconceptions About Need Spare Car Key That Aren’t Always True http://www.99811760.xyz

The Next Big Thing In Key Programming 5611432.xyz

Responsible For A Best American Style Fridge Freezer Budget?

10 Ways To Waste Your Money Zack Foxworth

10 Top Books On Car Locksmith http://www.elsycrays.top

Seo Always Be Invisible, Nonetheless Hidden 백링크 검사

What Is The Reason? Tabletop Freezers Is Fast Becoming The Hot Trend For 2023?

http://www.3222914.xyz

15 Of The Top Asbestos Attorney Bloggers You Need

To Follow cassylawn

This Week’s Most Remarkable Stories Concerning Akun Demo Hades

oscarreys.top

The 10 Scariest Things About Upvc Door Doctor upvc door Doctor

Keyword Strategies And Fundamentals That Affect Website Success 구글SEO

Best Credit Rating Personal Loans – 5 Tips For

Faster Personal Loan Approval 무직자 3000만원 대출

You Have To Know These Basics To Improve Search Engine Ranking

백링크 사이트

The Next Big Thing In The Private Psychiatrist Assessment

Industry psychiatrists

15 Amazing Facts About Getting An ADHD Diagnosis That You Didn’t

Know where do i go to get diagnosed for adhd (Trevor)

A Casino Slot Machine Strategy November 23 More Finances!

프라그마틱 추천

Ten Quick Etiquette Suggestions Business Lunches 프라그마틱 플레이

What You Can Use A Weekly Repair Window Project Can Change Your Life http://www.257634.xyz

15 Top Documentaries About Double Glazing Window Repair 257634

The Asbestos Disease Mesothelioma Case Study

You’ll Never Forget http://www.0270469.xyz

12 Facts About Integral Fridge To Get You Thinking About The Water Cooler

36035372

What Best Pet Care Experts Want You To Know 836614.xyz

How Boot Mobility Scooters Became The Hottest Trend Of 2023

arlennizo.top

The Top 5 Reasons People Thrive In The Corner Wood Burning Stove

Industry 913875.xyz

Why Bunk Bed For Kids Is So Helpful In COVID-19

http://www.eddafay.top

15 Terms Everybody In The Upvc Windows Repair Industry Should

Know Upvc Window repairs

Ten Upvc Window Repairs That Really Change Your Life upvc window repairs

Why Adding A Window Glass Repair Near Me To Your Life

Will Make All The Difference Window Repair (archive.Guildofarchivists.org)

Can Double Glazing Condensation Repair Kit Be

The Next Supreme Ruler Of The World? jerealas.top

Ten Upvc Window Repairs That Really Make Your Life Better

upvc window repairs – Lilly,

The 12 Worst Types Of People You Follow On Twitter http://www.cassylawn.top

Coffee Machine Coffee Beans: What Nobody Is Talking About Bean to cup coffee machine home

This Week’s Most Remarkable Stories About Upvc Window Repairs window Repairs near Me

5 Affordable Sleeper Couches Projects For Any Budget pet-Friendly sleeper Sofas

10 Things You’ve Learned About Preschool, That’ll Aid You In Repair Double Glazed Windows

repairer

10 Life Lessons We Can Learn From Lg Side By Side Fridge Freezer 36035372

5 Lessons You Can Learn From Why Are CSGO Skins Going Up In Price cs2 Cases

Solutions To The Problems Of Upvc Window

Repairs http://www.257634.xyz

These Are Myths And Facts Behind CS GO Case New case opening [Rhys]

15 Things You’ve Never Known About Can Hades Beat Zeus oscarreys

Why CSGO New Cases Is Everywhere This Year Csgo Cases

10 Things Your Competition Can Teach You About Double

Glazed Windows Repair misty

9 Lessons Your Parents Taught You About Couches On Sale Couches on Sale

The Best Double Mattress Memory Foam Tricks To Rewrite Your Life best Double

mattress, Onego.co.kr,

A Positive Rant Concerning Why Are CSGO Keys So Expensive csgo Cases

Watch Out: How Bunk Bed Price Uk Is Taking Over And What Can We Do About It

eddafay

15 Top Pinterest Boards Of All Time About Kids Bunk Bed Buy bunk beds

The Complete List Of Double Glazed Window Repair Dos And Don’ts window Repairs near me

2 Seater Chaise Techniques To Simplify Your Daily Life 2

Seater Chaise Trick That Every Person Should Know 2 Seater Chaise

5 Killer Quora Answers To U Shaped Settees co.n.s.u.m.erb.b.ek@www.pitchdecks.tv/index.php/User:TanjaStoneman5″>u shaped settees

15 Top Pinterest Boards From All Time About Upvc Window Repairs Upvc window repairs near me

You’ll Never Guess This Veleco Faster Mobility Scooter’s Tricks

veleco faster Mobility Scooter

20 Trailblazers Are Leading The Way In Best Double Bunk Beds bunk bed usa (Richelle)

The 10 Scariest Things About Sofa Sale sofa sale (Dessie)

11 Strategies To Completely Defy Your Play Slots Online kaymell.uk

An Easy-To-Follow Guide To Bean To Cup Coffee Machine best home bean to cup coffee machine

CSGO Cases History Techniques To Simplify Your Everyday Lifethe Only CSGO Cases History Trick That Every Person Must Be Able To csgo cases (Wilhelmina)

What’s The Job Market For Double Glazed Window Repairs

Professionals Like? double glazed window repairs

What’s The Current Job Market For Double Glazed Window

Repairs Professionals? Double Glazed Window repairs

Beware Of This Common Mistake With Your How Many Cases Can You Get In CSGO

Csgo Cases

What You Need To Do With This Slots Kay Mell

Nine Things That Your Parent Taught You About Spare Keys Cut Spare Keys Cut

What You Should Be Focusing On Enhancing How Many Cases Can You Get In CSGO csgo cases

Who’s The Most Renowned Expert On Kids Beds Bunk Beds?

Bunk Bed usa

See What Folding Wheelchair Lightweight Tricks The Celebs Are Using Folding Wheelchair Lightweight

How To Become A Prosperous Why Are CSGO Skins Going Up In Price When You’re Not Business-Savvy

cs2 Cases

The Hidden Secrets Of Why Are CSGO Skins Going Up In Price cs2 cases (Helena)

Responsible For An Best CSGO Opening Site Budget? 12 Ways To Spend Your

Money counter-strike cases (Lucie)

The Reasons To Focus On Enhancing Bean-To-Cup Coffee Machines bean to cup coffee machines reviews

You’ll Never Guess This Can Mobility Scooters Go On The Pavement’s Tricks can mobility scooters go on the

pavement, Penny,

Electric Wall Mounted Fireplace Explained In Less Than 140

Characters Lynn Bolvin

The Most Underrated Companies To Follow In The Repair Double Glazing Industry Philomena

Hyundai Spare Key Cost: What Nobody Is Talking About hyundai car fob replacement (Gemma)

17 Reasons Why You Shouldn’t Be Ignoring How Many Cases Are There In CSGO cs2 cases (vbb.luckygirl.co.kr)

5 Laws Everybody In Mesothelioma Asbestos Should Know cassylawn

How Many Cases Are There In CSGO: 11 Thing You’re Leaving Out Cs2 Cases

The Reasons CSGO Opening Sites Is Everywhere This

Year Csgo Cases

Solutions To Problems With Ethanol Fireplaces Tuyet

10 Startups That Are Set To Revolutionize The Keys Mercedes

Industry For The Better mercedes key Replacement

Do You Think Best CSGO Opening Site Ever Be The King Of The World?

Counter-Strike cases

5 Laws That Can Help The Best CSGO Opening Site Industry Counter-strike cases (greenpanvice.sk)

7 Little Changes That Will Make The Biggest Difference In Your

Double Glazing Repair Kit Gwendolyn

Lost A Car Key Tools To Improve Your Daily Lifethe One Lost A Car Key Trick Every Individual Should Be Able To lost A car key

What Is Wall Mounted Electric Fireplace And How To Utilize It?

lynnbolvin

How To Determine If You’re Set For Car Lock Smith elsycrays

Responsible For An Bunk Bed For Sale Budget? 12 Ways To Spend

Your Money eddafay.top

It’s The Next Big Thing In Kids Bunk Beds eddafay

A Look Into The Secrets Of Americanfridge Freezer

zackfoxworth.top

10 Reasons That People Are Hateful To Slot Demo Gratis Zeus

Vs Hades Slot Demo Gratis Zeus Vs Hades oscarreys

Bunk Bed In My Area: The Secret Life Of Bunk Bed In My Area eddafay.top

7 Helpful Tricks To Making The Profits Of Your Electric Fireplace Wall

Mounted lynnbolvin.top

10 Blown Double Glazing Repair That Are Unexpected jerealas.top

The Reasons Slot Demo Zeus Vs Hades Anti Lag Is Everyone’s Obsession In 2023 oscarreys

What Is Glazing Repairs And Why Is Everyone Talking About It?

jerealas.top

The Most Underrated Companies To Watch In Electric Fireplace Heater Industry lynnbolvin

Unexpected Business Strategies That Aided Carlocksmith

Succeed elsycrays.top

What Is Collapsible Mobility Scooter? History Of Collapsible Mobility Scooter

In 10 Milestones http://www.arlennizo.top

10 Startups That Are Set To Revolutionize The

Treadmill That Folds Up Industry For The Better zackfoxworth.top

5 Must-Know Hismphash Practices You Need To Know For 2023 zackfoxworth

11 Methods To Completely Defeat Your Kayleigh Wanless Pornstar pornstar Kayleigh wanless

Unquestionably consider that that you said. Your favourite reason appeared to be on the internet

the easiest thing to remember of. I say to you, I certainly get annoyed

whilst other people think about concerns that they plainly don’t recognize about.

You controlled to hit the nail upon the top and defined out the whole thing

with no need side-effects , folks could take a signal. Will likely be back to

get more. Thanks

Hi gregor-pfeiffer.at owner, Great job!

Hello gregor-pfeiffer.at owner, Your posts are always informative and well-explained.

what is a vpn? Betternet free vpn best vpn service review https://free-vpn-proxy.com/

what is a vpn? Betternet free vpn best vpn service review what is avast secure line vpn

best vpn for pc free download best buy vpn router unlimited free vpn – hola https://superfreevpn.net/

best vpn for pc free download best buy vpn router unlimited free vpn – hola hola vpn free

best vpn for the money free vpn netflix free linux

vpn https://imfreevpn.net/

best vpn for the money free vpn netflix free linux vpn best vpn for streaming

secure vpn pia vpn download best vpn for laptop https://shiva-vpn.com/

secure vpn pia vpn download best vpn for laptop completely free vpn

buy vpn client best vpn for fire tv best vpn location for

warzone https://ippowervpn.net/

buy vpn client best vpn for fire tv best vpn location for warzone best vpn for chrome free

norton secure vpn free vpn for phone best vpn routers https://freevpnconnection.com/

norton secure vpn free vpn for phone best vpn routers cyber ghost vpn

google vpn download best vpn free vpn firestick https://rsvpnorthvalley.com/

google vpn download best vpn free vpn firestick best free vpn for linux

buy dedicated ip vpn free vpn for google chrome reddit best free vpn https://accountingvpn.com/

buy dedicated ip vpn free vpn for google chrome reddit best

free vpn best vpn for binance

top vpn top rated vpn services top rated vpn service https://bordervpn.com/

top vpn top rated vpn services top rated vpn service best free vpn cnet

free unlimited vpn for mac vpn providers best free vpn for netflix https://govtvpn.com/

free unlimited vpn for mac vpn providers best free vpn for netflix best vpn for tor

best vpn netflix best free vpn for dark web free vpn firestick https://courtvpn.com/

best vpn netflix best free vpn for dark web

free vpn firestick best vpn service lifehacker

To the gregor-pfeiffer.at administrator, You always provide valuable feedback and suggestions.

Dear gregor-pfeiffer.at admin, Well done!

To the gregor-pfeiffer.at administrator, Your posts are always well-supported by facts and figures.

Dear gregor-pfeiffer.at webmaster, Thanks for the valuable information!

To the gregor-pfeiffer.at owner, You always provide great examples and case studies.

Hi gregor-pfeiffer.at webmaster, Thanks for the valuable information!

Hi gregor-pfeiffer.at owner, You always provide valuable feedback and suggestions.

Hello gregor-pfeiffer.at administrator, Thanks for the valuable information!

To the gregor-pfeiffer.at webmaster, Thanks for the detailed post!

Hi gregor-pfeiffer.at administrator, Your posts are always well-supported by facts and figures.

Dear gregor-pfeiffer.at admin, Your posts are always well written.

Dear gregor-pfeiffer.at admin, Great content!

Dear gregor-pfeiffer.at admin, Your posts are always well-received and appreciated.

Dear gregor-pfeiffer.at admin, Thanks for the well-organized and comprehensive post!

%random_anchor_text% %random_anchor_text% %random_anchor_text% https://customessaywwriting.com/

%random_anchor_text% %random_anchor_text% %random_anchor_text% .

essay writing help for high school students write my college essay me essay homework

help online https://writemyessaycheap24h.com/

essay writing help for high school students write my college essay me

essay homework help online best paper writing site

essay writers for pay professional essay writing help good customer service essay https://lawessayhelpinlondon.com/

essay writers for pay professional essay writing help good customer service essay help writing an argumentative essay

Dear gregor-pfeiffer.at admin, Your posts are always well-supported by facts and figures.

Hello gregor-pfeiffer.at webmaster, Keep sharing your knowledge!

To the gregor-pfeiffer.at webmaster, You always provide helpful information.

To the gregor-pfeiffer.at admin, Keep up the good work, admin!

Hello gregor-pfeiffer.at webmaster, Thanks for the informative post!

dating sites free for men browse free dating

without registering local dating sites free https://freewebdating.net/

dating sites free for men browse free dating

without registering local dating sites free best online dating sites

100% free dating service plenty fish date site dating online

dating https://onlinedatingsurvey.com/

100% free dating service plenty fish date site dating online dating onlinedatingsurvey.com

Hi gregor-pfeiffer.at admin, Thanks for the well-presented post!

international dating site usa free and best free chat now https://jewish-dating-online.net/

international dating site usa free and best free chat now dating for free

asian dating browse free dating without registering top dating websites https://onlinedatinghunks.com/

asian dating browse free dating without registering top dating websites best free online meeting sites

best date sites my dating sites dating for free https://freedatinglive.com/

best date sites my dating sites dating for free single date online

Hello gregor-pfeiffer.at administrator, Thanks for the well-written and informative post!

To the gregor-pfeiffer.at administrator, Your posts are always well-supported by research and data.

coursework requirements coursework cover page coursework vs

research https://buycoursework.org/

coursework requirements coursework cover page coursework vs research coursework or course works

coursework handbook coursework handbook custom coursework writing service https://coursework-expert.com/

coursework handbook coursework handbook custom coursework writing service coursework-expert.com

coursework planner nea coursework history a level coursework

gcse pe https://writingacoursework.com/

coursework planner nea coursework history a level coursework gcse pe quantitative coursework examples

do my coursework for me coursework based masters coursework gcse pe https://courseworkinfotest.com/

do my coursework for me coursework based masters coursework gcse pe coursework like copa

coursework vs thesis masters coursework vs dissertation coursework questions https://courseworkdownloads.com/

coursework vs thesis masters coursework vs dissertation coursework questions coursework in area of expertise

Dear gregor-pfeiffer.at admin, Keep up the good work!

coursework ucl coursework upm coursework master degree https://mycourseworkhelp.net/

coursework ucl coursework upm coursework master degree coursework in or on

coursework lincoln coursework ucl coursework writing service https://teachingcoursework.com/

coursework lincoln coursework ucl coursework writing service coursework knowledge definition

nursing coursework coursework at college coursework in academic writing https://courseworkninja.com/

nursing coursework coursework at college coursework in academic writing data analysis coursework